'How Much Lower Can It Go?'

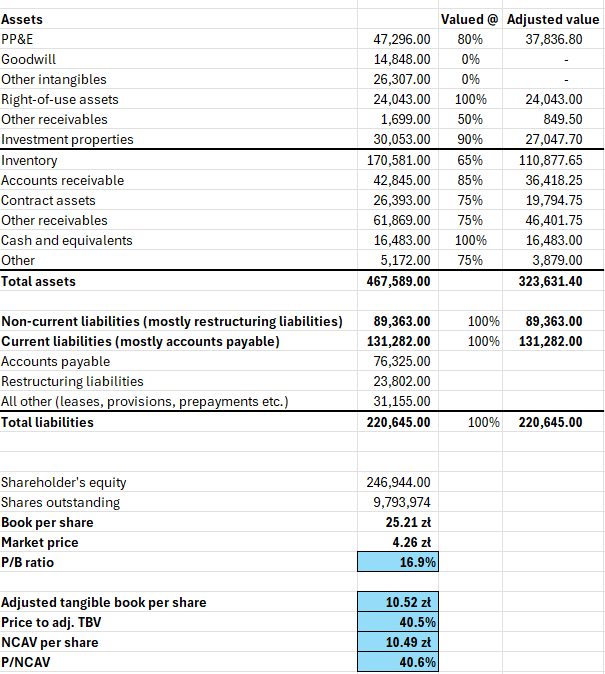

A tale of a Polish net-net trading at an absurd 16.9% of book value and 40.5% of NCAV.

This is getting ridiculous.

3 months ago, I wrote an article on a troubled Polish electronics retailer trading at 20% of book value, 47% of adjusted tangible book (my conservative estimate), and 47% of NCAV.

This company, which I remember fondly from my childhood, used to be massively popular years back. My very first PC I actually bought in one of their stores.

However, fierce competition and a brutal battle with the Polish IRS in court, which led to their involuntary restructuring, have crushed the public’s perception of the company. After suing the IRS, they eventually won, but the issues stemming from that situation have persisted. The restructuring is still ongoing, and pretty much right according to the plan.

In the latest earnings release, management reiterated that despite the challenging macroeconomic environment still putting a strain on the company’s operations, the objectives of the restructuring plan continue to be met without fail.

This company, now a shadow of its former self, is a struggling one. Yet, despite its current struggles, it's trading at an absurd discount — offering what I see as an extremely compelling opportunity for bargain hunters.

When I first stumbled upon this gem, I was astonished by how cheap it was. It was priced as if the company were to go bankrupt before the close of that day’s trading session. I recall this one famous speech by Peter Lynch — I am sure many of you have seen this one as well (if not, watch it – it’s hilarious):

Similarly, I too asked myself, ‘How much lower can it go?’

Yesterday I noticed that, since my last article, the company has plummeted another 25%. And why is it, you might wonder? Well, the recent quarterly results showed that the company lost 0.55 PLN per share. That is roughly 1/10 of my initial buy price (the average was 5.3 PLN). When looking closer, you could see that various financing costs accounted for more than half of that loss. Only 0.21 PLN was the actual operating loss.

The current industry environment of today isn’t exactly inspiring. Across Europe, there is still a noticeable oversupply of electronics inventory, and this, coupled with consistently falling demand for new products worldwide, is directly impacting the company’s results.

After all, why upgrade your phone to a newer model when the improvements are no longer as significant or groundbreaking as they once were? A new iPhone costs a fortune, but there is really not that much ‘new’ about it. I know some people might disagree here, but the numbers are clear on that — we buy less stuff than before.

The company is struggling to compete with more established stores that enjoy higher profit margins and a greater market share, and inflation issues only make it worse, impacting both the company and its customers.

I know that the company is rough around the edges, but aren’t we all?

The stock is now trading at just 17% of book value (20% of TBV) and 40% of NCAV. But this is a struggling retailer, not a Chinese pump-and-dump or yet another shipping company with incompetent management.

And the best thing is, the management of this company has just so many cards to play. The incentives are there as well, as insiders personally own a significant portion of the company.

Why would they let it burn?

Update 10/20/2024: a great question from Mostly Charts

When it comes to tax matters, the IRS in Poland can be... rather hostile, especially towards individuals, but businesses don’t have it easy either.

Management pointed out that their dispute went to court because the IRS’s decision was unlawful. The IRS probably figured, 'Why not give it a shot?'

After all, no one would be penalized for failing to collect that tax, but it would certainly be a big win if they managed to succeed. Cases like this aren’t as rare here as you might think, unfortunately.

So, while I’m no tax expert, I don’t see this situation as a sign of any dishonesty on the company’s part.

I don’t often make judgments about management’s quality because my experience has shown it can lead to mixed results. However, looking at the bigger picture, money provides quite a powerful incentive here. Insiders hold a significant ownership stake in the company - they were the founders, after all.

People can be good at hiding their true intentions, but when 100 million PLN is at stake, it’s hard to believe they wouldn’t care about the outcome - it’s just a lot of money.

In my research, I didn’t find anything in their past actions that could even remotely be described as 'dishonest.' They seem like a pretty solid group to me.

The numbers

Since the data used in my previous article is now six months old, I’ve updated my calculations based on the latest earnings release:

So, what options do they really have? Quite a lot actually. Let’s sum it up.