Smart investment in Smart Sand

A writeup on one of the largest suppliers of high quality frac sand, trading for 50% of the liquidation value, and my single biggest portfolio allocation, Smart Sand Inc. (SND)

Smart Sand ($SND) is one of the largest suppliers of high quality frac sand called Northern White (NWS), inefficiently priced at ~50% of liquidation value and 30% book, with pristine balance sheet and rapidly growing revenue and earnings. It’s a low risk, high uncertainty idea on improving frac sand market conditions and, at the same time, 25% of my portfolio.

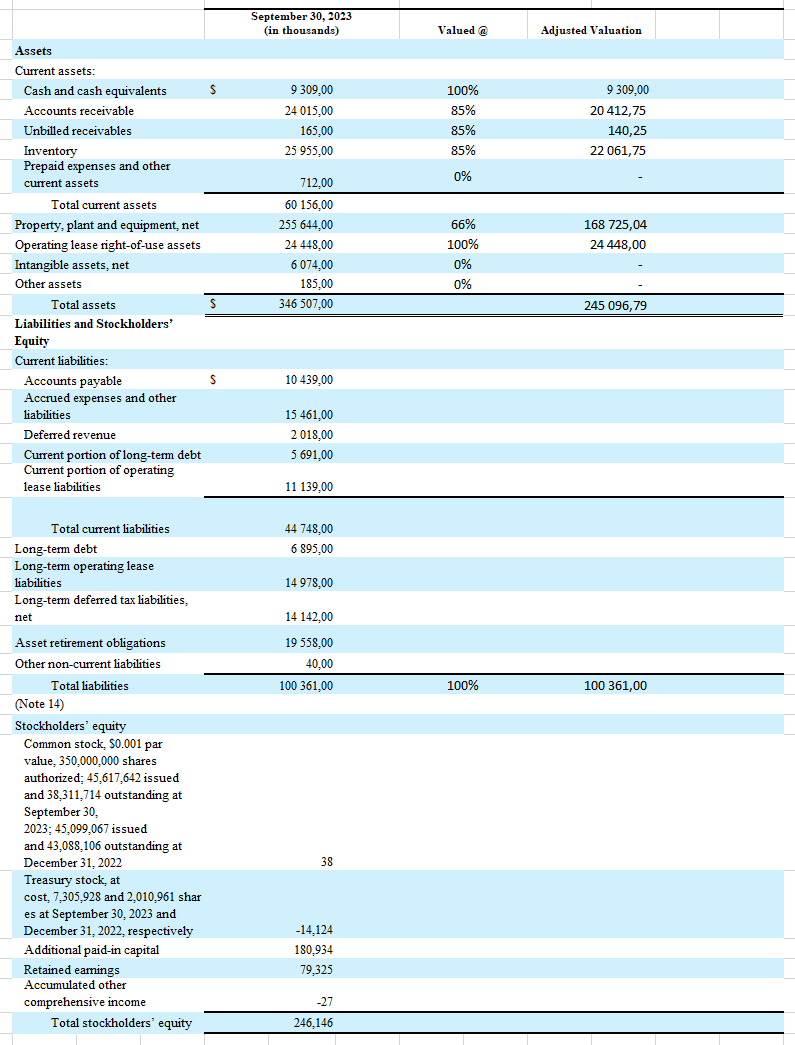

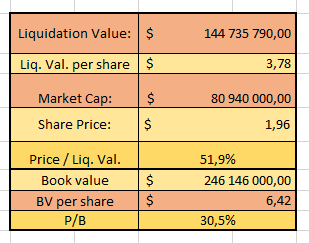

First, let’s see some numbers:

I’d say the calculations are quite conservative, but feel free to modify the discounts as needed. It’s still going to be cheap in my view.

So, why is it trading so cheaply?

In the middle of the previous decade, there was a frac sand boom, as selling sand was quite profitable due to supply constraints and fairly high demand. A few years of excess cash flowing to the companies selling frac sand, combined with unintelligent risk taking drove the industry from a boom, to a bust. Due to a sudden oversupply, sand prices dropped drastically. Costs had to be cut to save money, and Northern White (NWS), previously the most widely used type of sand due to its high quality, was replaced by in-basin sand (IBS) – worse in almost every way, but cheaper in the short term.

Around 2018-2019, as the situation had worsened to quite dramatic levels many of the drillers had already stopped buying the more expensive NWS, and started using solely this locally sourced in-basin sand. Two years later, the pandemic hit, and many of the highly levered frac sand suppliers went broke, as the lasting oversupply drove the margins down significantly.

This is the moment when Smart Sand started shining. Although the losses were quite severe, due to some wise past decisions the balance sheet remained in a great shape, and thus the company had a lot of opportunities to seize in buying cheap assets from their desperate competitors. For example, they bought a deactivated mine in Blair, Wisconsin from Hi-Crush for $6.5 million, which was first purchased by Hi-Crush for $75 million just 6 years prior.

Nonetheless, the industry itself was in shambles.

Around two years later, little sprouts of recovery started coming out, and that’s when I realized that Smart Sand might not be just an asset play, a cheap cigar butt that should be sold after a temporary price bump. That was the moment when everything started stabilizing and improving rapidly. Just look at the numbers:

So, the rapid expansion and the pillaging of the discounted assets in this hopeless industry started paying off (at least revenue-wise).

Mid-2022 I remember noticing that, hey, this quarter wasn’t that bad! And indeed, from then on, the results have only gotten better. It turned out that Smart Sand quickly became the second biggest provider of Northern White sand:

In the second quarter of 2023, the company opened its new Blair facility, and with access to Canadian National rail line could start expanding into the land of maple syrup and ice hockey which is, undoubtedly, a large market to penetrate. Again, the mine began processing sand in Q2 2023, so we have not yet seen the full impact of the expansion.

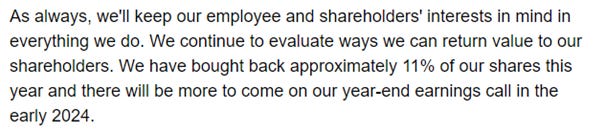

Additionally, in February they bought back 11.3% of its shares from a large private equity investor that was with the company since the beginning, Clearlake Capital, at an average price of $1.71 per share

I could sum up Smart Sand’s past few years as growing and getting ready. Although the share price went pretty much nowhere since those few years ago, (apart from a few temporary price bumps, which I took advantage of), the intrinsic value and the company’s potential have been very much growing.

Before we go deeper, it’s important to know how frac sand is used in the process of getting oil and gas from the ground.

To put it as simply as possible: “it's a process by which water, sand, and chemicals are injected underground at very high pressures to crack open rock layers and release the oil or gas trapped inside.”

Then the sand keeps those cracks in the rock you just dug into open for you to extract all the goodies you want. That’s why the quality of different types of frac sand matters here – if you use crappy proppants, you get less from your wells, as sand is slowly being crushed into smaller and smaller particles which clog the wells, continuously decreasing the volume of goodies available for extraction. What matters here is the size of the grains, the shape, the “roundness”, crush resistance and so on.

Northern White and in-basin sand

The problem remaining is the market’s perception on which type of proppant is the one that should be used today. Back when the industry started using IBS more than NWS, the costs started visibly dropping, obviously. Today, many customers still think it is the right idea to use cheaper IBS over the more expensive NWS, so the latter lost its position as the proppant leader. Fortunately for us, there is lots of evidence that tell a different story. For one, consider the most important evidence out of all, the report made by Rystad Energy

If you want to get more details on the methodology, geographic placement of the “test subjects” etc. I advise you to read the full report. My TL;DR to you would be that Northern White is superior to in-basin sand in the majority of cases, and allows drillers to get more oil and gas from the ground at lower costs in the long run, even considering the higher base price

Here is probably even better “TL;DR” than mine, so before you go further take a look at this article.

Some additional stuff to consider

In Q3 2023 earnings call, the management said

As well as:

So, sales at least 10% higher than 2023, and continued buybacks.

More buybacks would definitely be more than welcome, and looking at the available $9.3M of cash, it’s more than possible that the management will continue to reward shareholders this way, buying back shares at 30% of book. It’s even more plausible when you consider the fact that the CEO owns almost 7 million shares, or approx. 16.3% of the total shares outstanding, with additional 5.85 million shares (or 14.2%) held in his LLC, Keystone Cranberry, where he has sole voting and investment power. In total, he controls over 30% of the company.

Additionally, it’s worth mentioning that, apart from revolving credit facility and operating leases, Smart Sand has very little debt.

On top of that, Q3 2023 was one of the best quarters in the past few years, with net income totalling $6.7M, or around $0.18 per share. This was the first profitable year in a while for the company, and the market did not even acknowledge that, as the share price today still sits stagnantly below $2 per share. The turnaround is very much here, but the stock is still trading as if the company were to lose almost half of its value.

Also, due to the weather implications, the best quarters are typically the sunniest ones. During winter months production is limited, and producers must rely on the reserves gathered during warmer times, so that is why you can see that the best results are usually mid-year, or Q2 and Q3.

Apart from that, Smart Sand also pays annual bonuses at the year’s end, so that should also impact the upcoming quarter’s results (Q4, which should come out in a matter of a few days).

One more important thing would be that I have noticed that the management focuses a lot on driving down the costs of their product which, as we know, is a very important factor for the customers here. I found it difficult to compare just how large the cost differences are in comparison with Smart Sand’s competitors, so you could say this is where my analysis could be improved. One thing I will mention though is that from reading a lot of reports and transcripts of earnings calls, they seem very much aware of the power of being a low-cost producer and actively try to improve in this matter wherever possible.

In my view the biggest risk here is opportunity cost. The value in the company and its product is definitely there. The question is when this value is going to come out of the shares into the pockets of the investors.

My thesis here is not that Smart Sand is going to be a 100 bagger, but rather that it is a low risk, high potential opportunity. The downside is protected by the asset value and the sheer size of the current operations (which will undoubtedly be appreciated by the market when the current industry trends reverse, bringing great returns to the shareholders). It would also not take much for the share price rerating to happen – just some more good news as seen lately, and a little more eyes on the company. Seriously, there is surprisingly very little coverage of this industry. Even Bloomberg Terminal was of pretty much no use here. No wonder investors are so few and far between.

I’ve heard people say, “But Stonks, the rig count is dropping, how can the future bring better results for Smart Sand?”

Well, while it is true that rig count is indeed dropping…

…the oil and natural gas production is increasing

Which suggests that, with this in mind, companies have probably started paying more attention to well efficiency, rather than just the amount of them active at a given moment, which may actually be a good thing for Smart Sand. After all, if you want to increase the efficiency of your wells, why not switch to a better proppant?

Additionally, if you focus on making the wells “bigger” (increase the drilled lateral length) to maximize the extractable amounts of oil and gas, you will most definitely have to use more proppant.

It is also worth mentioning some other possible risks, such as the possibility of a sudden decline in the energy industry, which would undoubtedly hurt Smart Sand. This topic is as wide as can be, and every investor has a different view on the future of the energy market, so I will not try to convince anyone that we are either in a “commodity supercycle”, nor that the world will stop using fossil fuels entirely in the coming years, as I do not feel competent enough to have an intelligent opinion here.

Apart from that, we might also see some regulations and political moves when it comes to fracking that could do some damage to the industry. Again, nothing concrete.

To sum things up, I see Smart Sand as a low-risk opportunity, with a potential for high returns. The management is shareholder friendly and has skin in the game. The company trades for ~50% of liquidation value and 30% of book value, so we have a tangible margin of safety here, and practically no debt. The revenue increased from $127M in 2021 to $256M in 2022 and will probably reach around $300M for FY2023. The management predicts that 2024’s sand sales will increase at least 10%, as compared to this year:

I’ll be extremely happy to talk to you regarding this investment. I’d also highly appreciate any constructive critique, no matter how devastating to my huge ego.

Thanks a lot for reading! That was my first ever public writeup, so if you liked it, be sure to let me know and maaaaybe there’ll be more to come soon :)

Interesting story. Seems that Mr Market continues to ignore it.

Great analysis, my friend. I will consider buying some Smart Sand stock