What's In My Deep Value Portfolio? #3 [Part 2/2]

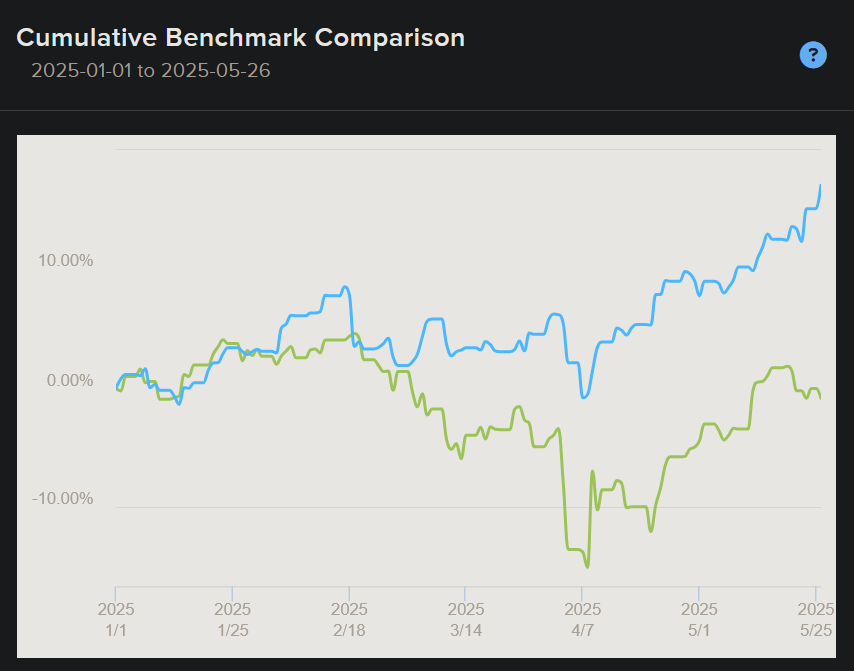

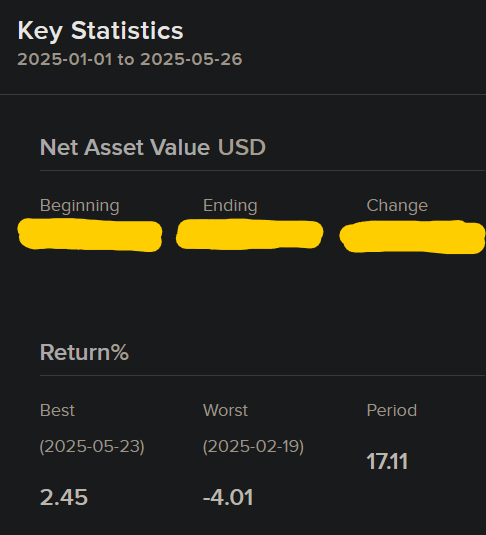

YTD return: +17.11%; A detailed portfolio update for my paid subscribers (as of 5/26/2025)

If you haven’t read [Part 1/2] yet, do it before you start scrolling down:

Current Portfolio Picks

Zytronic PLC (ZYT.L, 21.4%), a liquidation play.

Zytronic, the UK-based PCAP touch controller maker, is now winding down after a failed sale process. I initially expected around a 30% IRR on the liquidation, but management couldn’t secure a decent offer for the operating business. As a result, they’re now breaking up the company and selling it off in parts - which has dragged down the expected return.

Based on my average buy price of around 48–49p (varies slightly by account), and using management’s guidance, the total return from here looks to range between +22% in the best case and -6% in the worst.

While I still see Zytronic as a solid investment decision overall, I definitely bet too much upfront. Had I waited, the return could’ve looked a lot better.

After the outcome of the strategic review got published, the share price dropped rather sharply, reflecting lower-than-expected liquidation value estimates (result of the no-sale scenario). That was the moment to buy more, with shares trading at around 40–42p (management’s low-end estimate of the liquidation value is 46p). However, our position was already slightly too large for my comfort then.

That said, a few of you told me you did exactly that – picked up more shares around the lows. Good work :)

March 31st was the final trading day for Zytronic shares, and the delisting from AIM officially took place on May 15th. While regular trading is no longer possible, shares will still be tradable through periodic auctions on a Secondary Market Trading Facility following the delisting.

If you’re still a shareholder and haven’t read the latest Circular, make sure to check it out.

By the way - and many of you probably know this already - you don’t need to pay for any third-party service to get news alerts for the stocks you own.

When it comes to UK-listed companies: the London Stock Exchange lets you ‘follow’ them for the nice round price of 0 GBP! That’s a steal!All it takes is setting up an account on their site, and you’ll start getting emails like the one below (pixelated LSE logo included with no extra charge!):

It works like that on Euronext as well, if you’re interested in European stocks. SEC’s EDGAR database also has a similar functionality, but for that you’d need an RSS reader app/browser addon as well (see the orange button below).

I personally use Feedly for that purpose (it’s free, both as an addon and an app, at least for Android), but there plenty of free RSS apps out there.

Alternatively, you can use ConferenceCallTranscripts.org as well, but there’s a limit on how many stocks you can add to your watchlist without having to pay extra.

I find these tools very useful, so I thought you might too :)

Anexo Group PLC (ANX.L, 13.6%), a credit hire and legal services company from the UK, currently trading at 3-4x P/E and 46% of NCAV.