What's In My Deep Value Portfolio? #3 [Part 1/2]

YTD return: +13.51%; portfolio update as of 5/21/2025.

The Equity Market Today

Lately, I have been hearing comments on just how many cheap stocks are available now, after the market’s recent reaction to the announcement of US imposing tariffs on just about every country in the world, including that one with penguins as the dominant demographic group.

Frankly, I don’t see any drastic changes here, so it’s nothing like, say, April 2020.

Nonetheless, there certainly are cheap stocks out there - especially if you’re working with a smaller amount of capital. Across all managed accounts (mine and close family), we’re actually more than 85% in equities, with the bulk of that being non-US companies (~3/4th), as honestly, there's really not that many mouth-watering opportunities in the United States as some Substack writers claim to know of.

There’s probably enough to form a solid US-only portfolio if you're small investor, but not enough to get too picky, so take a hard look at anyone promising a brand-new “hidden gem” every two business days. I’ve seen enough of these pitches to feel obligated to say it:

The companies such people tend to cover are:

1) [fairly often] value traps dressed up like some ancient f*cking Indiana Jones relic,

2) [most often] not value traps, but still pretty mediocre deals, and not likely to shower you with much outperformance in the long term,

3) [always] selected less for merit, more for their ability of luring hopeful suckers in.

In this game, your credit card number is the only thing with guaranteed upside.

Don’t fall for quantity over quality.

…

Now, what was I saying? Ah, yes: ‘we’re actually more than 85% in equities’.

That remaining 15% doesn’t exactly scream “dry powder,” does it?

In theory, yes. But once you exclude our stake in Zytronic - a special situation with a pretty short time horizon, and incidentally, our largest position sized at around 22% of AUM (on average), the picture changes. Fast-forward 2 or 3 quarters, and assuming no new large buys, we’ll be sitting on ~40% cash.

While this doesn’t feel like the time to be swinging hard at most ideas out there, I certainly see plenty of things worth exploring. I’ve already got a few portfolio ideas that look really promising, and as soon as I get over with my temporary life-related workload, I’ll finally wrap the research and pass it to you.

As Peter Cundill, the legendary net-net investor, liked to say:

There’s always something to do.

My Obsession With Value

That being said, I feel more than sufficiently prepared for any potentially unpleasant market movements going forward. Our large cash position is, however, not a direct answer to any arcane predictions on the future of the stock market, but rather an indirect result of two things:

this rather small number of truly interesting deep value opportunities currently available, and

a tighter schedule that, up until now, has made it much harder to carve out time for deeper search of new opportunities.

In reality, most of what I initially label as “interesting” typically ends up being messier than I’d prefer. Deep value’s been hiding deeper than usual lately, and having a full-time job that’s outside of my everyday investment practices on top of that hasn’t made the search any easier.

However, I consider this temporary inactivity of mine to be a blessing rather than a curse in the market we have today. I was lucky to learn early on that frequent buying and selling of stocks can easily cloud one’s thinking and unnecessarily redirect focus away from what matters the most, which is turning rocks in search for those (and only those) that fit some ‘standards of attractiveness’ - however you define them yourself.

Pro tip: These standards, for what it’s worth, are most effective when set before you begin the actual ‘treasure hunt’, so not after putting half of your net worth into ‘a cutting edge high-tech firm out of the Midwest awaiting imminent patent approval on the next generation of radar detectors that have huge both military and civilian applications’.

I actually noticed that a little mental distance now and then goes a long way in avoiding the sort of unintentional self-sabotage I’m guilty of myself at times.

Basically, the more anxious you get about not finding great ideas, the more likely you are to 1) lower your standards and 2) do some dumb shit, whether you realize it or not.

In plain terms: that’s FOMO. Fear of missing out.

We all know how it feels.

Focusing on Objective Criteria

What I require from any investment has been shaped over the years by a lot of pattern-recognition and long, mostly intelligent debates with myself. Just because there aren’t that many stocks today that qualify as being ‘portfolio-worthy’ doesn’t mean I will/should start settling.

Concrete rules give you something to observe, tweak, and improve. The sooner you lay down clear rules for your investing process, the sooner you start getting feedback on how your current strategy actually holds up. Without them, every decision becomes a really draining mix of guesswork and gut calls, which are often based more on whatever the market has thrown at you lately, than on any principles that can actually stand any tests of long-term durability.

They're never perfect at first, obviously, but setting some rules that actually live outside of your day-to-day headspace is the very first step toward making your process more efficient, certainly less stressful, and much less reliant on chance.

That’s when real growth happens.

“If you don’t know who you are, the stock market is an expensive place to find out”, after all.

(that’s a quote from Adam Smith’s “The Money Game”, which was actually recommended in the 1968 Buffett Partnership Letter, by the man himself (here I mean Buffett, not Smith). I have yet to read the book, though I’ve heard it’s absolutely fantastic.

I like simple things. I prefer cases where the undervaluation is obvious and doesn’t require reading stuff for two straight weeks, just to then reach the conclusion that…

…yeah, 3% is the most I’d be comfortable putting into this stock.

That’s not to say I never get into more complex situations - I do, but most of the time, especially during market conditions like those of today, it feels smarter (both in terms of upside and required time investment) to just hold cash and “go play golf” until yet another no-brainer shows up (of course, I don’t mean ‘stop analyzing stocks until something magically tells you that it’s the right time to come back’, but rather ‘don’t sweat it’).

Of course, such an approach isn’t for everyone. Some people genuinely believe that working 30 more hours per week to deploy that extra 3% of cash now and then is where their alpha comes from - and hell, maybe it’s true, who am I to judge?

But is it really the most effective use of one’s time?

Certainly, not in my case.

I’d rather spend that time with my family or obsessively reading ‘Oil 101’:

Margin of Safety, but simplified.

It’s easy to overestimate how much of our outperformance comes from skill, effort, the structure of our investing process, and how much is just due to plain luck. Oftentimes, the proportions change quite rapidly.

At the end of the day, putting cash into stock XYZ is also a decision to give up the optionality of holding that cash for something potentially much better.

Of course, if you buy something cheap at, say, 5x earnings, you might find something even cheaper at 4x earnings the very next day (ceteris paribus). Then, you can probably sell the more expensive company, and buy the cheaper one, with your only cost being your broker’s fee.

Just a single day has passed, after all.

But then again, it might as well be a week or a month, and during that time the stock could go down significantly, even if just temporarily - you never know.

In this example, your initial purchase was so damn cheap that you could easily say to yourself “I did the best I could with the information I had”, and that would be it.

Case closed.

You couldn’t possibly predict that a significant drop would happen, but you correctly evaluated the investment in the first place and concluded, with a reasonable degree of confidence, that this particular one should reach your preferred rate of return - in this case 20% (or whatever return you're actually aiming at), so you’ve made a perfectly rational decision.

Even if you’ve also unknowingly made a mistake somewhere during the process of the initial analysis, that bargain price you paid provided you with a margin of safety wide enough to effectively cover that mistake multiple times.

However, it would be a whole different story if you’d instead settle for ‘kinda cheap’.

Settling - buying ‘kinda cheap’ just because there’s nothing immediately better in sight - can often be very dangerous for your performance (and your mental health).

In both cases, you might find something cheaper the very next day and just switch to that better thing without any real issues or extra costs.

But there might be a market crash the very next day as well, no matter if you buy expensive or cheap - again, you never know. And if not a market crash, maybe a 20% drop during the next few days (such tendency for the share price to fluctuate, I should note, is especially visible in case of deep value stocks, but less so when what you’re buying is already dirt cheap).

Should you then sell at the 20% loss to buy the cheaper company, or wait for it to come back and risk losing the opportunity?

Maybe you’d keep your original purchase for now AND buy the second one at the same time, while waiting for that stock price to come back up?

Best of both worlds, isn’t it?

But what if it turns out that the 20% drop was actually justified by some important change in the fundamentals? Your investment would effectively then be worth 20% less, and that’d certainly hurt no matter the price you paid.

Speaking in terms of investment performance, however, buying ‘cheap enough’ in the first place gives you a significant edge, both in terms of any potential returns, and in terms of the degree of risk involved.

In theory, a company worth 10$ per share bought for $5 can give you 100% return.

Buy that same company for $4 per share and your potential return goes to 150%.

“What’s that!? Oh no! The company you’re invested in just had an extraordinary one-time loss of $6 per share! What a bummer!”

Well, if you agreed to overpay, you’d effectively lose 20% of your initial investment.

In the second case, you’d still break even.

When you allow yourself to settle, a few things effectively happen:

You discount the importance of the margin of safety,

You limit your potential upside (the smaller the undervaluation, the smaller the expected return), and

You reinforce your own impatience, by giving yourself that lovely dopamine hit from finally putting this damn cash to work! (even though, deep down, you know you shouldn’t).

And yeah, the kind of conservative approach I employ will almost certainly cost me a few percentage points here and there in the short term by keeping the bar so high up. Nonetheless, I’m fairly confident that patience will more than offset that paper opportunity cost when shit really hits the fan.

Now, I know what you’re thinking after reading all of this theoretical mumbo jumbo:

‘Hold thy prattling, good Sir Stonks - unveil thy ledger’d gains forthwith!’

or something like that…

So, before I bore you all to death with value investing theory, let’s get to the fun part:

What’s In My Deep Value Portfolio

(and some numbers as well):

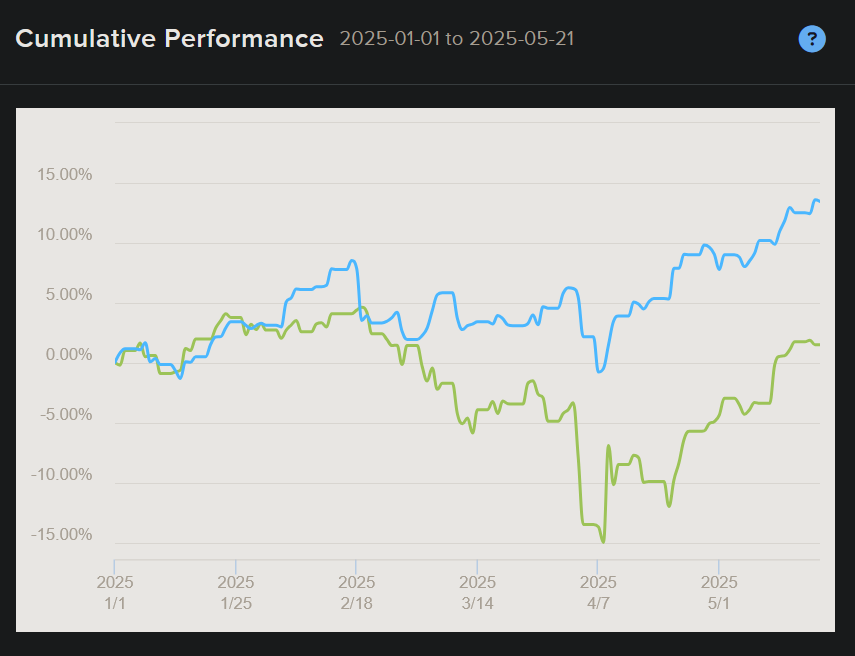

There was this nice thing I had the pleasure of experiencing in the first half of 2025: while the S&P 500 fell by around 15% during the recent tariffs-driven correction, we stayed a few percent in the green. That's a pretty satisfying gap.

You can see the divergence starting to show up on the chart around February-March. Now that the index is back to flat on the year (actually up like 1.5% as of 5/21/2025), we’re still ahead by about 12%.

Margin of safety, baby!

Of course, I don’t want to read too much into any short-term results, as ‘nobody, I don’t care if you’re Warren Buffett or if you’re Jimmy Buffett, nobody knows if the stock is gonna go up, down, sideways, or in f*cking circles’ - unless you’re a member of Congress, that is.

And yes, that’s already my second quote from The Wolf of Wall Street - I rewatched it for like the 11th time in my life recently (although, I’m pretty sure ‘those are rookie numbers’ for some of you here…)

Even though YTD results have this funny tendency to fluctuate wildly at times (especially true for us, practitioners of the ancient art of deep value investing), I’ve noticed the same pattern repeat over the years:

We rarely go down as much as the market does - when it does.

I’m pretty sure this all ties back to my admittedly uncommon criteria for deciding which stocks to buy and which to skip, with an absolute obsession over the margin of safety theory at the core of it all.

I feel like being so picky in this particular way is probably the main reason why we’ve been doing so well over the years. But then again, it’s only been 5 or 6 of them since I started doing things ‘The Graham-and-Dodd Way’. Maybe I mistake luck for skill or good strategy, as it feeds my hungry ego?

After all, who knows if our outperformance will continue?

Value investing has been around for almost 100 years old now.

Maybe it too can die of old age?

A Brief Note

After spending tens of hours on writing, then rewriting, polishing and perfecting each word and each sentence in this ‘What’s In My Deep Value Portfolio’, I noticed one thing:

It’s was just so damn long!

Seriously, the second half ended up getting so ridiculously long, that when I showed it to my fiancé, she almost fell asleep halfway through!

Apparently, talking about OTC small caps doesn’t count as foreplay for some people…

Her loss, honestly.

Anyway, I decided to split it into two separate pieces. I will post the second half next week, once I give it a quick finishing touch, and after I take my girl for a fancy dinner…

It will be available for my paid subscribers exclusively, as a detailed breakthrough of our portfolio picks, with my thoughts on each of them, and how they’ve been performing lately, plus as a few other updates.

But come on, you didn’t think I’d just leave you hanging now, did you?

You came here to see What's In My Deep Value Portfolio, after all!

Here’s a quick summary:

Zytronic PLC (ZYT.L, 21.4%), a liquidation play.

I initially estimated around 30% IRR on this investment, but management couldn’t secure a decent offer for the operating business, which has dragged down the expected return.

March 31st was the final trading day for Zytronic shares, and the delisting from AIM officially took place on May 15th. While regular trading is no longer possible, shares will still be tradable through periodic auctions on a Secondary Market Trading Facility following the delisting.If you’re still a shareholder and haven’t read the latest Circular, make sure to check it out.

You can find my writeups on Zytronic here, and here.Anexo Group PLC (ANX.L, 13.6%), a credit hire and legal services company from the UK, currently trading at 3-4x P/E and 46% of NCAV. Probably the cheapest business I have ever owned.

It’s a growing company with a recession-resistant business model, real barriers to entry, and some very smart owners - so smart, in fact, that they’ve graced us with a buyout offer at today’s depressed valuation, generously offering minority shareholders unsecured loan notes instead of cash, as a token of their good will!I believe Anexo is worth at least 150–200% more than what the current market price suggests,and it looks like the management wants to keep that value for themselves. Unsurprisingly, a group of us - minority shareholders who oppose the deal - got together to figure out how to push back.

If you’re currently a shareholder, please reach out to me via Substack, Twitter, or by email at stonksvalue@gmail.com

Natural Alternatives International (NAII, 8.9%), a terribly stupid mistake.

NAII is a cheap supplement manufacturer dealing with what I still hope are temporary demand issues.

And I want to stop here for a moment, if I may.In my previous ‘What’s in my Deep Value Portfolio?’ I wrote:

The company expects to post net losses for FY2025 (already started), but profitability is expected to return by the second half of the year, just not enough to fully cover the losses from the first half. Currently, it is trading for ~$4.5, and my liquidation value estimate is around $9. Since my initial purchase, the stock fell more than 30%. I still like it, although NAII was probably a mistake in terms of the initial sizing - I simply got too greedy and sized it too large on misjudged conviction. Still, I expect this investment to turn out satisfactory. Lesson learned.

A few things have changed since then:

The company now expects further losses for the second half of FY2025.

NAII is trading below $3 per share.

We’re now down nearly 50%.

I’ve come to realize just how extremely stupid my original investment decision was.

In fact, buying NAII at above $6 was probably the dumbest investment I’ve ever made.

For whatever reason, I convinced myself this was a great pick for a large position (something like 15% of the portfolio at one point…)The sheer number of mental biases I confidently welcomed into my brain is just inconceivable.

Even though the mistakes are painfully clear now, I want to make sure I never forget this lesson, so one of my upcoming articles will walk you through the whole case in all its embarrassing detail.

I’ll lay out what I initially saw in NAII, what I actually missed, and how a shitload of well-dressed cognitive biases and mental shortcuts led me straight into one of the worst investments of my life.It’ll be part breakdown of how some of those biases work (with a nod to my old friend Daniel Kahneman) and part honest confession, but I mostly just want it to be a reminder of how easily settling can turn into overconfidence and poor judgment, which will lose you money sooner or later.

A proper kind of a postmortem, if I may.

That said, even though I clearly overpaid, I’m still holding my shares.

In the second part of this article, I will also explain why.Citizens Bancshares Corp (CZBS, 4.5%), an overcapitalized, conservatively-run bank (and ECIP recipient) with very competent, high-integrity management. It’s trading at a P/E of ~7–8, below its ECIP-adjusted TBV, and has been a very satisfactory investment so far. Although I’ve trimmed the position some time ago, I still believe Citizens offers considerable upside potential with relatively low risk.

Orchard Funding Group (ORCH.L, 4.6%), a net-net/special situation I bought at around 17–18p last year. At the time, it was trading at just 20% of book value, with a low single-digit P/E, consistently profitable, and paying an 18% dividend. We sold most of the position after about a month for a ~70% gain but still hold a small stake.

I wouldn’t be surprised to see a tender offer at a premium or even a management buyout at some point - not to mention that the stock still is ridiculously cheap, even at 38p, as it’s trading at 40% of book value and 3-4x normalized earnings.Paywalled Polish net-net (4.8%), formerly, one of the most recognizable electronics and hardware retailers in the country, trading at just 22% of book value, 52% of its NCAV, and with insiders holding over 50% of total shares outstanding.

Currency Exchange International (CURN/CXI.TO, 4.4%), a foreign currency exchange and payments services company operating in the US and (formerly) in Canada, with many growth opportunities, competent management (especially the CEO, who also owns around 20% of the company), repurchasing shares, and trading at $91.8m market cap, while having $71m in [cash + ST receivables - total liabilities]. CXI has recently announced a wind-down of its loss-making Canadian subsidiary, which should have a positive impact on the company’s future earnings.

Liquidia Corp (LQDA, 4.3%), a special sit; bet on the FDA drug approval. Although not my usual pick, I consider the risk-reward here to be very enticing. You can find a lot of good information on Liquidia on Twitter.

Vindexus S.A. (VIN.WA, 5.3%), a Polish debt collection agency, consistently profitable for many years now, with very little debt, trading at ~45% of book value, 52% of NCAV, and mid-single digits P/E ratio. Writeup available here.

Kronos Bio (KRON, 2%), a special sit originally behind a paywall. The thesis was pretty clear (company sale or liquidation), and what the management had to do was pretty straightforward as well, but of course, they had to screw it up…

Call it a ‘special sit gone stupid’ (more on that in the second part though).Tenaz Energy Corp (TNZ.TO, 5.6%), an O&G company with a CEO who actually understands capital allocation, and who last year secured a ridiculously good deal for high-quality gas assets in the Dutch North Sea.

summed everything up better than I ever could:

This one guy(If you’re reading this by any chance - seriously, fantastic writeup. I’d love to see more of your work)

Just days before the announcement, the stock was trading under $4.

Now, less than a year later, it’s at $16.I vaguely remember looking at it around $8 or $9, but it felt too good to be true, so I initially passed. Thus, we are ‘only’ sitting on 40% gain now, but it could’ve been a lot more…

On the bright side, that hesitation is what led me to finding out about ‘Oil 101’, so let’s call it even…

Paywalled European net-net (4.4%), trading at ~30% of book value, ~5-6 P/E, with 75% of market cap in cash, consistently profitable for 15 years, with no debt, and paying a 4.2% dividend. One of the best net-nets I’ve found in a very long time.

Seaport Entertainment Group (SEG, 2%), a classic Greenblatt example of a spin-off with rights offering, straight from the third chapter of ‘You Can Be a Stock Market Genius’. I’m sure most of you have already heard about this on Twitter.

But hey, before you go…

If you’re not yet my subscriber, why not become one? I will provide you with writeups and updates on the cheapest deep value plays I come across. From mispriced cigar-butts, all the way to misunderstood special sits.

Transparency.

I’m all about being open with my picks and how they’re doing. You’ll get regular updates through “What’s In My Deep Value Portfolio?”, where I break down my current holdings, explain exactly why I think of my investments as also worth your while, and share how much I’ve put into each.

No noise.

I value your time as much as my own. You won’t see any “filler content”, no mile-long posts that take forever to read, but contribute nothing to your life. There’s plenty of that in social media already. My main goal as a writer is to provide you, as a reader, with the highest return on time and money invested.

You pay for value, I give you value.

Hope you enjoyed the read. If you’ve got any thoughts or suggestions, drop a comment. I’d love to hear from you.

As always, good luck and happy hunting!

Stonks

Show us screenshot of 5year CAGR and I’ll consider premium!

The part about investment philosophy was great to read!

"Settling - buying ‘kinda cheap’ just because there’s nothing immediately better in sight - can often be very dangerous for your performance"

So true!